Introduction: Why Client Retention Matters

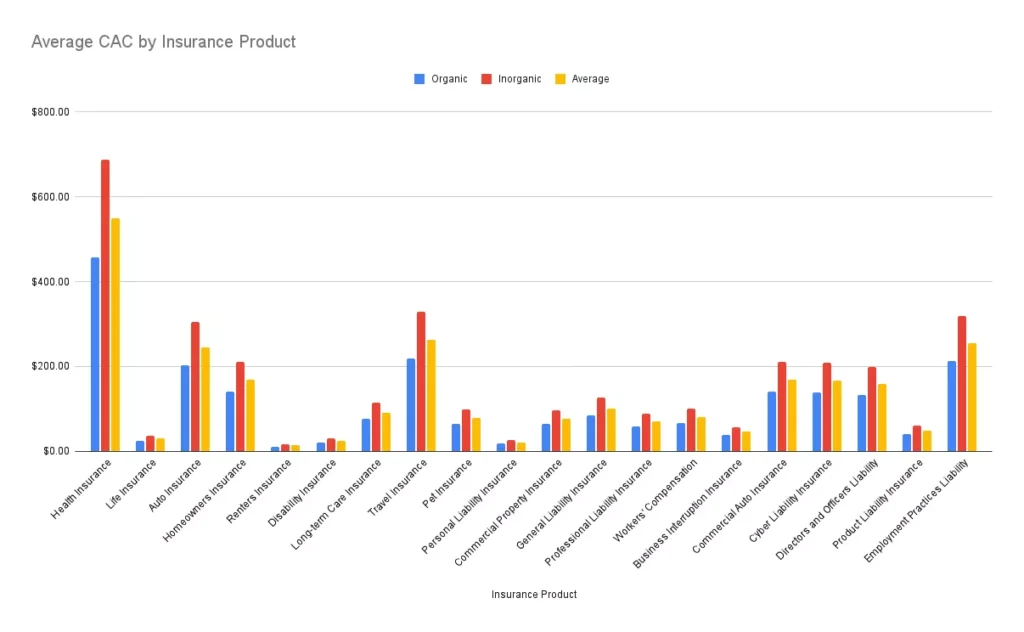

As an insurance provider, you’ll appreciate how much it costs to attract new customers. According to 2024 research by Chase McGee, the ratio of the Total Amount Spent on Marketing to the Number of New Customers Acquired may be summarized across the industry by the following graphic:

Customer acquisition costs vary depending on whether an organization uses comparatively low-cost organic advertising, or more complex inorganic marketing methods. Either way, the upshot remains the same: Customer acquisition costs are typically high (over $600 per customer, using inorganic marketing methods in healthcare).

A more economical and longer-term solution for insurers is therefore to retain the customers you already have. With strategic planning and proper implementation, you can as an insurance provider maximize customer retention at the various stages of the client’s insurance journey. Effective multi-channel communication and engagement with the client have a role to play in this.

How Multichannel Communication Helps Insurance Sales and Client Retention

Human interaction is essential to the insurance industry business model. Effectively communicating what your organization has to offer and providing prospective clients with a positive experience helps in attracting new customers, and the generation of new business through referrals. Creating and nurturing positive relationships between clients and agents helps foster loyalty, and boosts customer retention.

With a multichannel communications strategy, insurers can facilitate engaging and two-way interactions with clients, across a range of dynamic channels. For instance, with the IDT Express Omnichannel Messaging platform, you can use notifications to ensure that your clients never miss important dates, appointments, and renewals. You can use IDT’s marketing tools to boost engagement with special offers, loyalty promotions, and discounts to drive business growth. With IDT Express Omnichannel, you also have the convenience of managing 15 different messaging apps all in one place. In addition, you can leverage a powerful Application Programming Interface (API) to seamlessly connect with your audience across a multitude of channels

Using an omnichannel messaging platform like IDT Express, your insurance organization can readily satisfy the three key requisites for success in multichannel communications.

In the first instance, with a range of options (SMS, email, voice, social media, instant messaging, etc.) you can empower your clients to choose their most appropriate time and medium for reaching out to your representatives. An omnichannel messaging platform like IDT Express also provides you with the tools to effectively connect with your customers at every stage of their insurance journey. Finally, a multichannel communications platform with data analytics and reporting capabilities can provide you with a single view of each customer, which enables you to keep track of their activities and communications across each channel.

However, you may miss out on all these benefits if you fail to utilize multichannel communication – or if you misuse the multichannel options that are available to you. This could happen in a number of ways, as detailed below.

1. You Don’t Have a Smooth Onboarding Process

You may be offering insurance products which are highly competitive in terms of pricing, features, or conditions. However, if customers need to take a nightmare journey in order to get to them, you’ll lose out.

What may tip the balance in your favor is creating avenues that make it pleasant and simple for prospective clients to sign up with you. For example, you might create a Welcome message with information for prospects about contacting their insurer, filing claims, or performing routine tasks such as printing ID cards, along with helpful tips for risk mitigation.

Knowing that prospects often conduct online research before buying insurance, you might include a glossary of terms or Frequently Asked Questions (FAQ) on your website and social media. You could also compose a set of articles comparing different types of insurance, or blog posts on reducing risks that can drive up the cost of insurance premiums.

With IDT Express Omnichannel, you can share multimedia content and engage in rich and interactive conversations with your audience on the world’s most popular messaging apps. Using IDT Express Bulk SMS, you can reach all mobile users instantly, ensuring delivery and engagement – and use alerts to keep your audience informed with general information that matters.

2. Failing to Engage With Your Clients

If you’re not reaching out to your customers, you need to be. Engagement is the catalyst for further engagement. Policyholders get more value from their insurers through proactive communication that helps them solve problems. For example, with IDT Express Omnichannel Messaging, you can send helpful text messages such as reminders when a premium payment is due, or to update the customer on a claim.

3. You’re Starving Your Customers of Information – or Giving Them Too Much

It’s important not to skimp on your outreach to your clients, and starve them of the vital information they may need to make critical decisions. Equally, it’s important not to overdo it.

You can use customer data to establish when and how often to send proactive messages to your clients. Consider preferred times of day, day of the week, and period in the month – all based on perceived customer needs.

Using IDT Express Omnichannel for your multichannel communications, you can enjoy reliable coverage across the globe, ensuring that your messages reach your audience, no matter where they are. You can also set up automatic failover to ensure uninterrupted communication with your customers, with a flexible failover system that guarantees your messages always find their way, even in challenging scenarios.

4. You Don’t Appreciate Your Clients Personal Worth – or Show an Understanding of Their Finances

By tailoring messages to individual customers based on their history and personal preferences, you can increase engagement and promote loyalty to your organization. To this end, you should avoid generic messages, and look for ways to show your customers that they’re more than just a policy number. This can range from simple measures like addressing customers by their names, to offering personalized discounts, and providing relevant and timely information.

IDT Express Omnichannel Messaging offers SMS and instant messaging tools that empower you to deliver personalization at scale, so you can tailor your messages to create a personalized experience for each recipient.

To display an understanding of the finances of your clients, you should organize retention campaigns around the times when your customers routinely receive their paychecks. Your aim is to be first on the list when they pay their bills – but also not to annoy them with excessive demands and too frequent engagement. IDT Express Omnichannel Messaging provides scheduling facilities that make it easier to handle time-sensitive communications and reminders.

To illustrate the importance of good scheduling, you should note that Insurtech Center research suggests that sending a customer a reminder message when their policy is about to be canceled boosts renewals by 52%. So for example, if a policy is due to expire, you might message the customer before, during, and after the cancellation period.

5. You’re Not Providing Multi-channel Options for Engagement

According to Insurtrech Center data, customers who frequently use Interactive Voice Response (IVR) return a 25% higher retention rate than those who rely solely on communications with live service agents. However, there will of course be times when a customer prefers a human interaction. The trick is to provide options for all the kinds of communication that your customers routinely or occasionally employ.

With a multichannel communications platform like IDT Express Omnichannel Messaging, you’ll have access to a broad spectrum of engagement options – voice communication, SMS, social media messaging, etc. – on a platform that ensures seamless messaging across diverse channels.

6. You Don’t Have Quality Data about Your Clients

High quality data enables successful automation, which in turn promotes engagement and customer retention. For multi-channel engagement, you therefore need synchronous, regularly updated and high quality data systems – ideally, with powerful analytics and reporting capabilities. Remember that automation enables your customers to take the lead in solving problems, making payments, and accessing relevant information.

With the IDT Express Omnichannel Messaging platform and IDT Express API, you can integrate your multichannel communications with your Customer Relationship Management (CRM) and other customer-facing systems, to develop a single customer view across multiple channels. Using data analytics and reporting tools, you can develop a clearer picture of each customer and their insurance communications journey. In addition, you can develop useful insights into how client interactions and behaviors can drive future engagement.

7. You Don’t Provide 24/7/365 Options

Insurance-related issues will frequently occur outside of normal office hours – so it’s important to provide resources and support options that your customers can access at any time. Insurtech Center research indicates that 20% of customers actively use an insurance portal at the weekend, while 48% make premium payments outside standard business hours.

This emphasizes the importance of providing a presence, and some kind of customer access at all times, and across multiple channels. In this way, you’ll enable your clients to make enquiries, get quotes, sign up, request your services, or check their status, using their preferred avenues of interaction.

Using IDT Express Omnichannel, you can streamline your customer support processes by managing tickets and providing timely updates. With the platform’s intelligent ChatBots, you can enhance customer engagement, automate responses, handle routine queries, and create personalized interactions, providing a seamless and efficient experience for all your users.

To learn more about IDT Express Omnichannel, talk to one of our experts today, to see if we are a good fit for you. And to get $25 Free Test Credit with a Trial Account, visit our sign-up page.